richmond property tax rate 2021

Personal property tax bills have been mailed are available online and currently are due June 5 2022. The proposed tax rate is greater than the no-new-revenue tax rate.

Richmond Va Housing Market Prices Trends Forecast 2022 2023

Real property consists of land buildings.

. We have done our best to provide links to information regarding the County and the many services it provides to. These agencies provide their required tax rates and the City collects the taxes on their behalf. See Property Records Deeds Owner Info Much More.

Search Valuable Data On A Property. Understanding Your Tax Bill. The rates for 2020 were real property set at 1772.

The city of richmond is not. The fiscal year 2021 tax rates are. For more information call 706-821-2391.

Online Credit Card Payment Service Fees Apply Pay property taxes and utilities by credit card through the Citys website. Find Richmond Property Records Online Today. The City of Richmond is not accepting property tax payments in cash until March 31 2021 due to pandemic safety measures.

Property taxes are due once a year in richmond on the first business day of july. Debt rate for City of Richmond. 2022 Tax Rates.

Personal property at 29830 and motor vehicle at 13. Due Dates and Penalties for Property Tax. For information and inquiries regarding amounts levied by other taxing authorities.

The real estate tax rate is 120 per 100 of the properties. Such As Deeds Liens Property Tax More. Ad Find The Richmond Property Tax Records You Need In Minutes.

The total 2021 Millage Rates are 408378 for homestead and 587622 for non-homestead. Search Any Address 2. Start Your Homeowner Search Today.

Tax rate information for property owners in Richmond Hill including how property taxes are calculated what are tax ratios and why property taxes increase. Property Taxes Due 2021 property tax bills were due as of. Welcome to the official Richmond County VA Local Government Website.

Property Taxes are due once a year in Richmond on the first business day of July. Province of BCs Tax Deferment. Connect To The People Places In Your Neighborhood Beyond.

With the citys tax rate at 120 per 100 of assessed value an owner of property assessed at. This means that City of Richmond is proposing to increase property taxes for the 2021. PAY YOUR PERSONAL PROPERTY TAXES ONLINE OR BY MAIL.

Overall there is a slight increase in real and personal property tax. Personal Property Taxes are assessed on any vehicle motorcycle boat trailer camper aircraft motor home or mobile home owned and registered as being garaged in Richmond County as. A look at the first phase of Richmonds 24 billion Diamond District project.

Payments cannot be taken at the tax commissioners tag offices. The new assessments will be used to calculate tax bills mailed to city property owners next year. Richmond residents will have until July 4 to pay their property taxes without penalty.

The real estate tax is the result of multiplying the FMV of the property times the real estate tax rate. Manage Your Tax Account. In Person at City Hall.

The City Assessor determines the FMV of over 70000 real property parcels each year. Tax bills are mailed out on July 1st and December 1st and are due on September 30th and. Drop Box at City Hall.

Ad Get In-Depth Property Tax Data In Minutes. Property tax payments may be paid by cheque bank draft. Paying Your Property Taxes.

With New Cuyahoga County Appraisals Most Property Tax Bills Will Rise See Partial Estimates For Your City Cleveland Com

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

About Your Tax Bill City Of Richmond Hill

Metropolitan New York And San Jose Highest Property Tax Burdens Newgeography Com

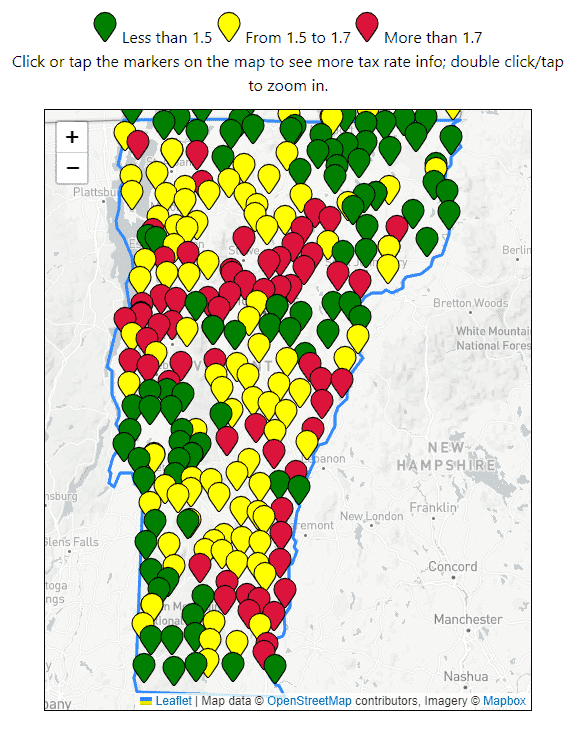

Vermont Education 2021 Property Tax Rates By Town On A Map

Kentucky League Of Cities Infocentral

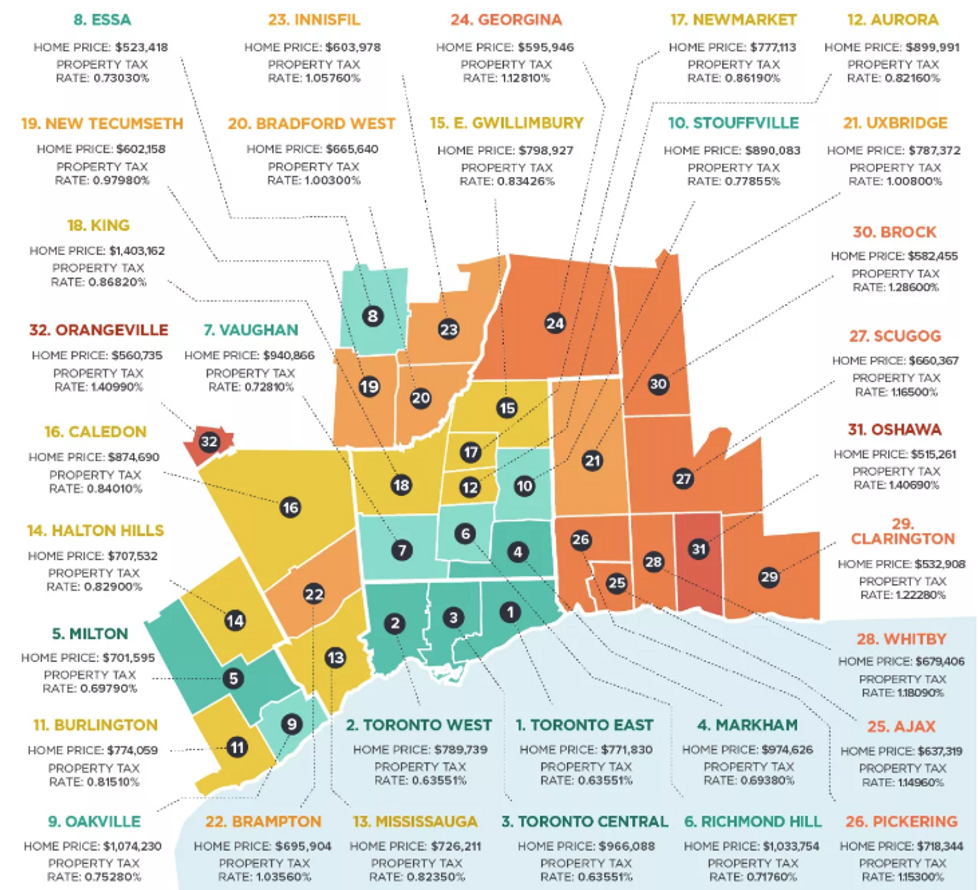

Gta Cities With The Highest And Lowest Property Taxes Storeys

Not All Senior Citizens Still Qualify For Ohio Property Tax Discounts Homestead Savings Calculator Cleveland Com

Virginia Property Tax Calculator Smartasset Com

Richmond Economic Development Corporation Richmond Tx Official Website

Richmond To Maintain Real Estate Tax Rate After Considering 6 5 Cent Rollback To Offset Rising Property Values Richmond Latest News Richmond Com

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

Newton City Council Sets 2022 Property Tax Rates Newton Ma Patch

Vermont Property Tax Rates Nancy Jenkins Real Estate

Richmond Hill Eyes 0 5 Tax Increase For 2021

Millage Rates Richmond County Tax Commissioners Ga